Microfinancing is a financial service made available to impoverished individuals who do not meet typical banking qualifications. Microfinance institutions create a rare opportunity for borrowers to access the financial system. For example, with farm financing, an impoverished farmer may access capital that he can then use to scale his business to provide food to his community and income for his family.

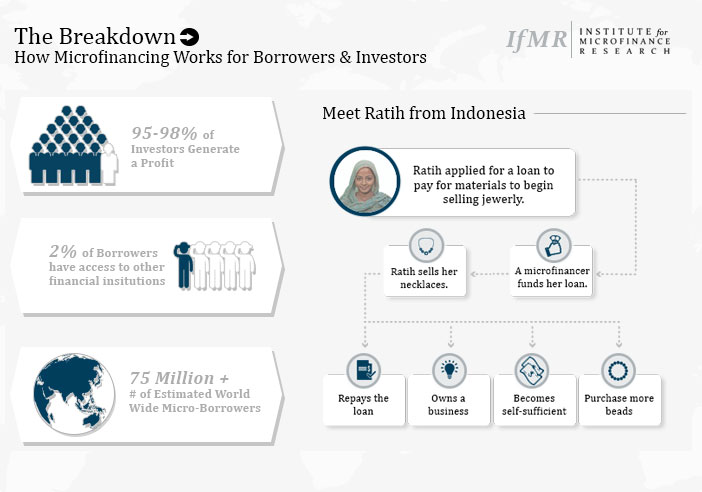

Learn More ➜The Institute for Microfinance Research provides financial resources to microborrowers and investors. Have you taken an interest in this fairly new financial industry? You're not alone. Offering an approximate 98% repayment rate for investors and providing a small cash loan for those battling poverty, the microfinance market gives both parties incentive to participate.

Learn More ➜There are thousands of microfinancing institutions catering to eligible borrowers and investors. If you are a borrower, chances are you have these financial institutions available near you. A microloan can finance agricultural expenses and farm land leases, pay for materials used to start a small business, cover essential medical expenses, and more.

Impoverished individuals who are generally excluded from traditional financial services can apply for microfinancing to pay for farm and agricultural expenses, healthcare, small business expenses, and more.

For those looking to expand their financial portfolio, investors should remember to notice how the market is evolving. Microcredit first began with an idea from Muhammad Yunus in 1976. The microfinance system has proven beneficial to the investor - not just the borrower. These loans provide low income families a chance to lift themselves out of poverty. Microfinance provides small amounts of cash with affordable interest rates. Since low income borrowers are usually denied by commercial banking institutions, those who are granted a microloan tend to be loyal when given access to credit. Often, these individuals return to secure a second microloan, start a savings account, or begin investing in a microfinance insurance plan. This investment opportunity shows no signs of slowing down. The Institute for Microfinance Research explores microfinancing in depth, the newest peer to peer investment opportunity.